Last Friday, the price of Bitcoin ($BTC) went below $37,000. At its all-time high, $BTC was nearing $69,000. Solana ($SOL) wasn’t immune to this crypto crash and had a bit of bad luck with the timing of its network congestion. It went down to $81 on the 24th of January. Just 4 days earlier, $SOL was trading at $140.

This downward trajectory may seem alarming but remember: Markets go up, markets go down. Even the stock market experiences this. Since the NASDAQ’s peak in November, it has fallen by 14.3% while the DOW continues its longest streak of daily declines since February 2020.

Solana’s Growing Pains: As the market was crashing, Solana’s throughput went down significantly, partly due to the explosive use of DeFi (Decentralized Finance) in recent months. Due to market volatility, leveraged DeFi positions became eligible for liquidation. Users borrowed USD and used $SOL as collateral, then sold their collateral, returned the borrowed money and took the liquidation bonus. Users employed automated bots to compete at being a faster-than-the-speed-of-light liquidator. Couple this with Solana’s cheap transaction fees, liquidators sent multiple duplicate transactions in order to get on the next block. Although these transactions were invalid, they still needed to be verified by validators. As a result of these intensive computations, the Solana network became heavily congested.

The Solana team released patches for network efficiency. And, since the 1.8.14 release on the 23rd of January, network performance is relatively stable. Growth often comes with a little pain.

🔴 What happens to the NFT market when crypto portfolios see red?

All-time Solana NFT sales has surpassed $1 Billion. We’re really early considering we saw the first Solana NFTs emerge in March 2021. So, did the state of Solana affect NFT holder behaviour? In the last 24 hours, 70,623 SOL has been traded in volume on Magic Eden and the amount of page views went up by 229.23% (~1.57M). Bullish, much?

Although there is a correlation between the crypto market and NFTs, it’s not in the way you might expect. Sentiment is the biggest connection between the two. We (the people) set the floor prices. To not take an L, floor prices would obviously go up as holders delist and adjust prices. For example, if someone is aiming to take profit at $140.13 and if 1 SOL is now $81, they would need to price their NFT at 1.73 SOL to take profit at the desired value.

Furthermore, when crypto is down, NFTs are a viable means of profiting and according to @kropts, they do relatively well but where crypto crashes past a certain point, overall confidence tanks. To @The_SOLo_Dolo, the real impact is felt around blue chip NFTs. Boryoku Dragonz’s floor price is up by 42.92% and Mindfolk is up by 51.72%. When crypto is in the red, the true blue chips shine.

📈 Key observations:

- Established blue chips saw the most increase (some like Boryoku saw ATH)

- Time-tested smaller cap projects stayed stable in value

- Newer, more speculative projects took the biggest hit

💰 When your crypto bags are in the red…

- $SOL: The best time to buy $SOL. Have a rainy-day stablecoin bag.

- High Quality Plays: Good projects pump. Think of it as time to make a play into one of the more established projects. - @The_SOLo_Dolo

- Conviction: Don’t put in what you can’t afford to lose. Don't get antsy dumping $SOL into every project you can find just because you want to multiply your $SOL to get back to the original value pre-dump. - @deep_sheets

- Know where you stand: You’re either a believer/risk-taker or you play it safe. Believers should take advantage of NFTs, instead of crypto. With NFTs, you’re a collector or investor. An investor should be able to handle risks. - @zeyfromdiscord

- It’s okay to sell: You may miss opportunities but you can learn. Take your 5x and leave, unless you highly believe in the team. It’s okay if you don't sell the top. - @kropts

The lows are the best time to build. We’re here for the long-term and crypto is here to stay. Corrections are a normal part of the crypto growth cycle. If you’re a believer, you know that bear market or not, it’s temporary. Your JPEGs are forever… and if you made a great call, you’ll end up at the top.

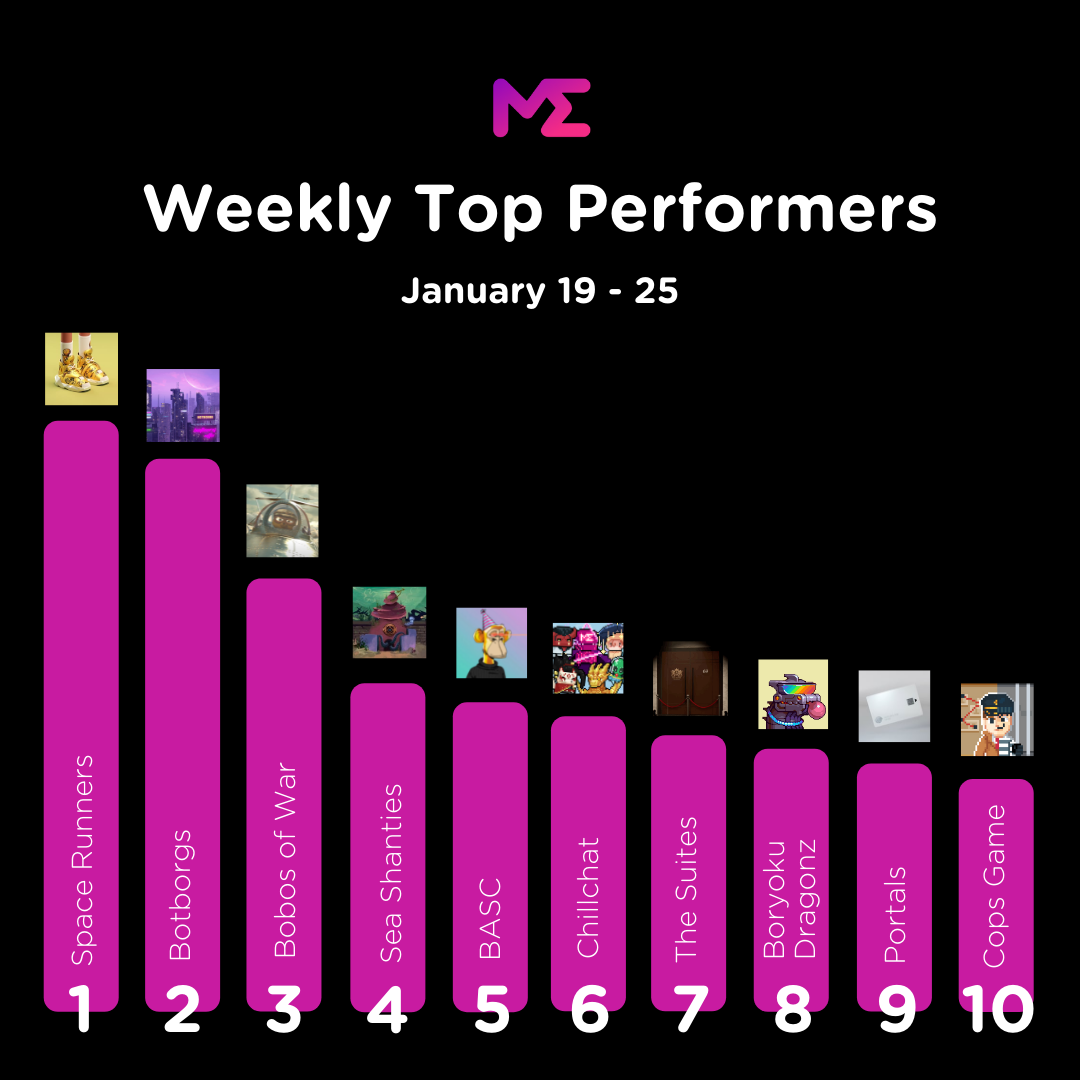

🪄 Congrats, this week's top performing collections on ME! (1/19-25)

🚀 Launchpad Releases

Launchpad is Magic Eden’s full-minting support service with cutting edge capabilities, outbound marketing support and automatic listing. We provide the widest reach, exposure and tools for creators to launch their collections on Solana.

Best Buds

Best Buds are bringing 420 to the metaverse.

4,200 NFTs minting on Jan 28, 9.20PM UTC

Galactic Fight League

Galactic Fight League is a play-to-earn strategy based fighting game.

9,999 NFTs minting on Jan 29, 5PM UTC (presale), 9PM UTC (public sale)

Koala Koalition

Koala Koalition will construct their playground on 9 plots in Sandbox.

3,333 NFTs minting on Jan 30, 8PM UTC

Tongue Tied Society

Tongue Tied Society is a handpainted set of NFTs. Burn a deck, receive a 1/1 painting.

5,200 NFTs minting on Jan 30, 10.20PM UTC

Infinity Serpents

Infinity Serpents is Gen2 of Fancy Diamond SOL.

3,333 NFTs minting on Jan 31, 6PM UTC

Sovana

Sovana is the Club Penguin of Solana. A metaverse project.

5,000 NFTs minting on Feb 1, 12.30PM UTC

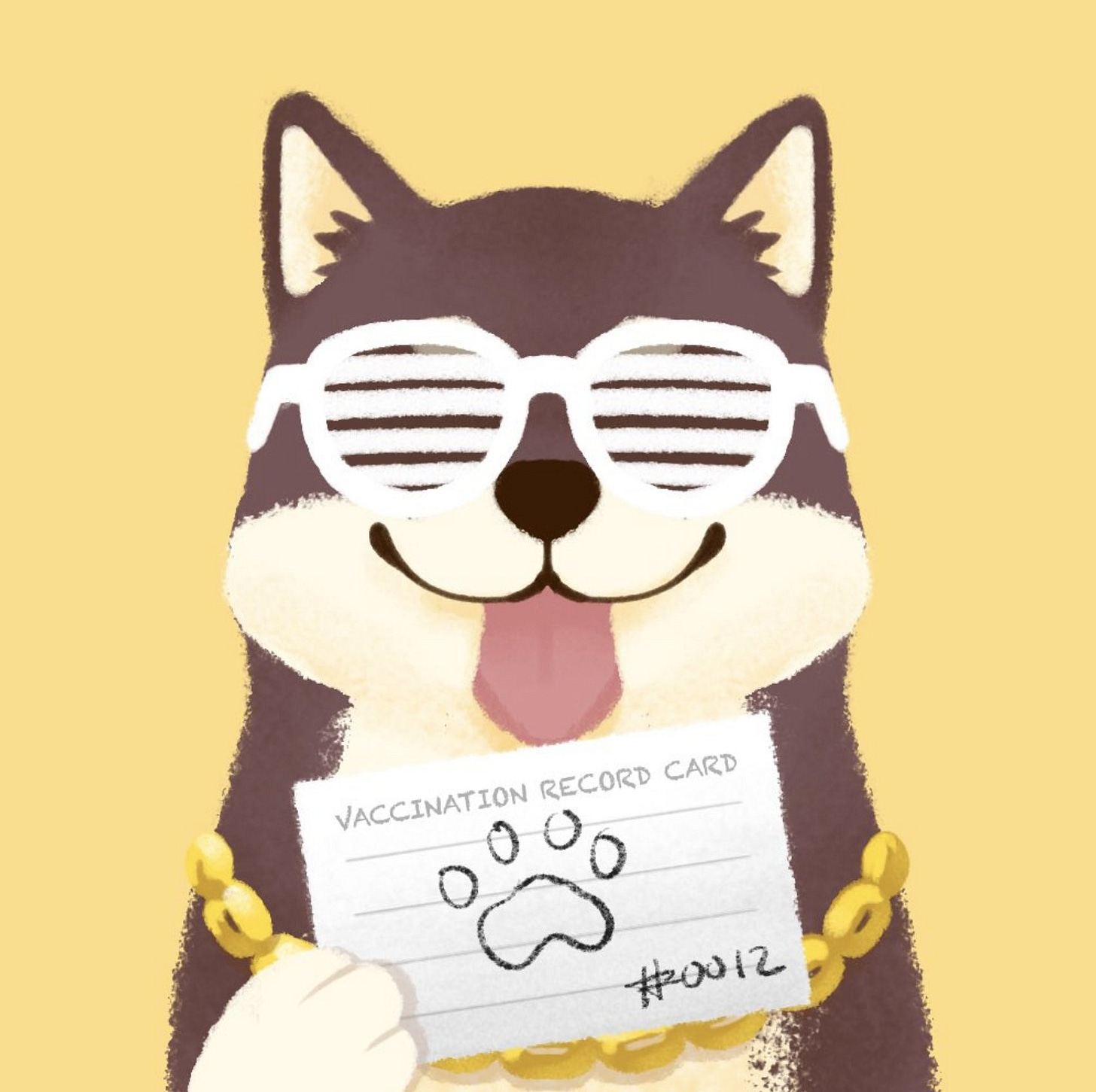

Vaxxed Doggos

Vaxxed Doggos are a collection by YouTuber Joma Tech.

2,500 NFTs minting on Feb 1, TBD Time

🖼 Upcoming Auctions

On Magic Eden, creators can hold both Dutch and English auctions. Check out live auctions here!

Wednesday, January 26

- “Isseu & Fatima” by Wayne Lawrence (Immutable Image)

Thursday, January 27

- “Red #0” by Christopher Anderson (Immutable Image)

Friday, January 28

- “Greg Louganis, CA 1983” by Walter looss Jr. (Immutable Image)

Monday, January 31

Tuesday, February 1

- “THE DEATH OF SALOMONDRIN” by Alejandro Saloman